Financial capital

In line with the objectives set out in the Group Business Plan to develop a capital structure that supports growth and attracts strategic, long-term investors, CCR Group ended 2016 with growth of 8.9 percent in net revenue, an increase of 46.9 percent in adjusted EBITDA, and an adjusted margin of 80.1 percent, up 20.22 p.p. compared with the previous year.

Net income increased by 96.0 percent to R$ 1,713,851 thousand. On the same basis, net income was R$ 850,781, decreasing by approximately 3 percent, excluding the sale of Serviços e Tecnologia de Pagamentos (STP) to DB-Trans Administração de Meio de Pagamento for R$ 4,086,000,000.00. Of this amount, R$ 1,484,423 thousand refers to the company's 34.2372 percent interest in the business, of which R$ 68,522 refers to dividends received on the date of the sale.

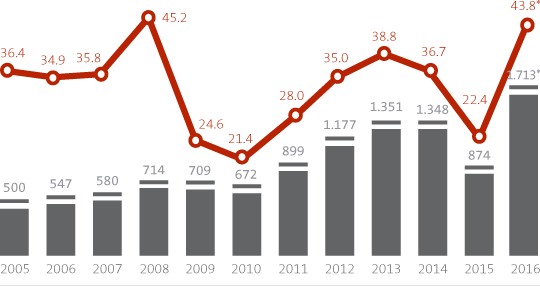

PROFITABILITY

Key results

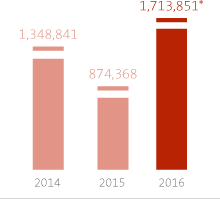

NET INCOME

(R$ thousand)

*Total income including the sale of STP. On the same basis, R$ 850,781 not including the sale of STP. ROE calculation ot including the sale of STP: 21.7%.

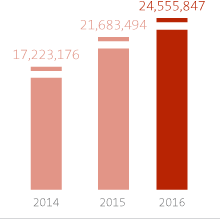

NET REVENUE

(R$ thousand)

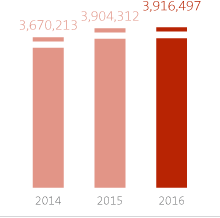

SHAREHOLDERS' EQUITY

(R$ thousand)

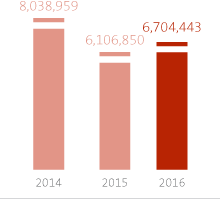

TOTAL ASSETS

(R$ thousand)

R$ 6.2B

in direct economic value generated

DISTRIBUTION OF ADDED VALUE

(R$)

| ECONOMIC VALUE DISTRIBUTED | 2016 |

|---|---|

| Operating costs | 6,566,717,000.00 |

| Employee salaries and benefits | 554,176,853.11 |

| Payments to providers of capital | 750,000,000.00 |

| Payments to Government | 1,534,699.00 |

| Community investment | 36,453,000.00 |

| Total | 7,908,881,552.11 |

| ECONOMIC VALUE DISTRIBUTED (%) | |

| Operating costs | 83.02% |

| Employee salaries and benefits | 7.00% |

| Payments to providers of capital | 9.48% |

| Payments to Government | 0.02% |

| Community investment | 0.46% |

| Total | 100.00% |

| ECONOMIC VALUE RETAINED | |

| “Direct economic value generated” less “Economic value distributed | 2,087,185,447.89 |

Dividends

CCR Group is committed to creating value and to the profitability of the business. Virtually 100 percent of net income for the period was distributed in the form of shareholder dividends.

learn more

About CCR Group’s financial performance, visit the Results Center on our Investor Relations website here, or read the full report here.